Introduction

Many business process improvement initiatives seem to focus mainly on the very high visibility processes of the enterprise such as the supply chain, order fulfilment or customer service management, while negelecting the smaller but supporting everyday processes, including travel authorizations, expense filing and timesheets. These smaller processes, when poorly designed or designed without considerable care in the business rules and policies enforced, could mount in cost over a period of time. This paper seeks to examine a simple but relatively common implementation of a manual expense filing and reimbursement process and using the help of BPM simulation tools, derive some insight into the true costs of managing this process at a small company. In addition we identify ways that organizations could improve the ROI of an expense process in order to maximize efficiency and effectiveness.

Problem Description

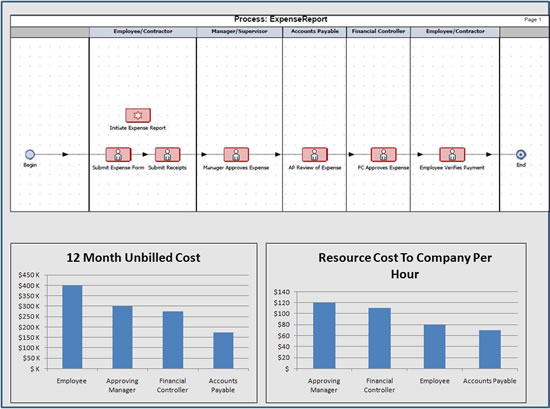

Expense report filing and reimbursement is a routine process in almost any organization today regardless of size or location. While very few companies have fully automated processes, most companies still make use of manual or semi-automated processes. Filing an expense report typically begins with an employee taking time (typically unbilled time) to prepare the report in accordance with the norms and policies of the company. The filing process for the employee involves gathering up of transaction receipts, locating form templates, appropriately filling out the fields of the form, checking, sigining and finally submitting the expenses to a reporting manager for approvals. Senior managers would then approve / disapprove the report and move it on to the finance group for further approvals, filing, scheduling and ultimate payment to the employee. In many instances, the finance team may have one or two levels of approval before final payment is issued. Finally the employee verifies payment to their bank account , signaling the conclusion of the process.

There are two important challenges that may arise with this process:

- As a non billable activity (usually), it means the priority given to filing expense reports relative to other revenue generating activity is lower – an effect that is evident to the employee. While the employee is motivated to recover their funds, the lower priority attributed to the expense usually introduces a delay into the initial filing of the expense report. This usually leads to a scramble at the end of a financial review period to synchronize actual expenses with the appropriate periods in which they were incurred. Older unfiled expenses simply add to the complexity and workload.

- While each step of the process appears relatively simple and straight forward, having too many redundant checks increases the cost by requiring expensive resources to validate each expense report. In addition to the lower priority participants may place on their required actions, there usually is a tendency to quickly approve small value expenses while spending a relatively larger amount of time examining large expenses.

Simulation

As a case study, we ran a BPM simulation of the expense filing process for a small company with 300 employees over a 12 month period. In a given week, about 60 employees submit expense report for reimbursement each week, and all expenses for a given month must be filed before the month end. Expense reports filed ranged in value from $30 to $6000. The policies enforced include:

- Manager approval s of expenses capped at $1000, but no floor.

- Senior manager approvals of expenses capped at $2000, but no floor.

- Managers, Accounts Payable (AP) clerks and Financial Controllers (FC) must review every expense report before approving expenses as a check mechanism

- No petty cash reimbursement process in general.

- We assumed the following loaded costs (to the company) for the different resources as:

- Employees : $80/hr

- Managers: $120/hr

- AP Clerk: $70/hr

- Financial Controller : $100/hr

For simplicity, we did not consider the increased costs of exceptional activity such as expense items with no matching receipts, disapprovals for exceeding caps, non-expense items such as alcohol, personal items, etc. or the failure of participants to file reports on time

Analysis

From our simulation results, it is clear that processing 2500 expense reports per year can cost a company upto $1.35 million in unbilled cost. Depending on the distribution of the expense report value, the cost of processing can be significant relative to the value of all expenses processed.

|

Figure 1

A number of insights gained from the simulation include:

- Employees constitute the highest cost – with the gathering of receipts & report preparation (photocopying and creating the actual inputs to the process) taking the greatest amount of time. These costs could have been reduced in a number of ways:

- Automation of the process to reduce expense report creation time.

- Providing a simple way to upload expenses – investing in a common scanner pool to capture receipts and tag them to expense reports; eliminating paper submissions to the extent possible.

- Approving managers constitute the second highest cost variable in the chain because they are the most expensive resources of the process; relatively inefficient compared to the finance team and likely to spend a greater amount of time reviewing expenses. Once again, a number of cost reduction strategies could be considered:

- Building a floor on the value of expenses that need managerial review. The key is to strike an organizationally acceptable balance that permits the least possible number of expenses to be approved by a manager.

- Providing a petty cash pool to handle the very smallest transactions.

- Providing automated process management to facilitate quick approvals.

- Building in escalation rules to limit delays in the overall process.

- Financial controllers constitute a high cost as well because they are also relatively expensive and they review each expense form (albeit for a very short period of time). However, because they are a trained resource they have a much higher efficiency rate and will generally have a lower variation in the time taken to perform their task.

- Financial controllers act as a reliable check in the process however, they do add cost to the process. Organizations can tailor the need to get financial controller approvals only for expenses exceeding a particular threshold.

- Compensate for the loss of the financial controller check with better training from accounts payable clerks or random sampling by clerks on a routine basis.

- Accounts Payable clerks constitute the lowest cost because they are very efficient relative to the other participants and have significantly less work to do than a manager – who is the first line of defense in catching errors and permitting workloads through. This role can benefit greatly from a reduction in tasks that are tangential to the expenses approval and payment process such as archiving of reports, report generation and payment submission.

Conclusion

Organizations looking to identify areas of process improvements should pay close attention to “less visible processes” in their organizations. All processes regardless of priority to the company have real costs incurred in their performance. As demonstrated, these costs can be significant. Through careful business process and rule design, along with the aid of simulation tools, organizations should raise the priority of supporting processes; determine the true cost drivers of their processes and improve them through policy and redesign to reduce cost and delay. Over the medium to longer term, there should be increased satisfaction from the participants of these processes as well as tangible benefits on the company bottom line.