In these pages over the last year we have focused on the business value of separating Business Rules from Business Process, and using Business Decisions as both organizing principal for those Business Rules, and as a means of managing the rules. The value of the Business Decision Management (BDM) approach is multifold, as the Business Decision is the natural means of connecting Business Rules to Business Process in a BPM environment. This creates both an agile business and technology environment, where Business Rules and Business Process can be governed by different stakeholders (if necessary), managed separately, and implemented on different technologies. The approach provides a natural environment for an SOA approach, where Business Decisions that are strategic to the business, or that contain rules that are changed frequently, or that are reused by multiple processes, can be implemented as Business Decision Services.

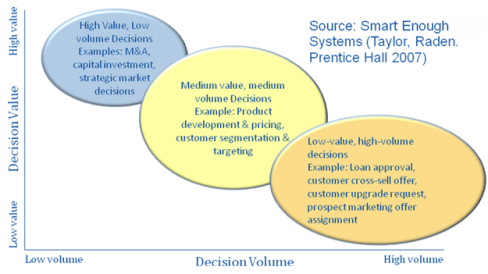

For the most part, we think of BDM as the management of “operational” Business Decisions – i.e. Decisions that are made within conventional operational business processes. I often quote from the excellent book by James Taylor and Neil Raden, “Smart Enough Systems” (Prentice Hall, 2007) where the authors categorize Business Decisions between low volume, high value decisions (“strategic”), medium volume and medium value decisions, and high volume low value decisions (“operational”). Figure 1 illustrates this categorization.

Figure 1: Categorization of Business Decisions

Taylor and Raden focus on the value to the enterprise of focusing on the management of the low-value, high volume decisions: properly managed these can add very significant value.

However, there is ample evidence that the management of Business Decisions across the spectrum of decision categories lends itself to BDM methods. While the scope and frequency may be different, managing strategic decision making by using a combined BPM and BDM approach can yield very significant benefits.

The poster child for the success of the combined BPM and BDM approach at the strategic level is Pitney Bowes.

Pitney Bowes is a $6b corporation that six years ago decided to set off on an acquisition program to position itself as the “global leader of mailstream technology solutions and services.” In simple English the company wished to transform itself from being a manufacturer of mail services hardware to a an organization with a software and services focus. In an article in the Harvard Business Review of September 2007, Bruce Nolop the CFO and Executive Vice-President, admits that when they started down this path, they were “one of the companies that had not yet figured (acquisitions) out.” But, he says that they developed what turned out to be a really good idea – to treat buying other companies as a business process.

The article then sets out to describe the disciplined formal approach that was developed over time as the company become more and more experienced in the process of acquisition. Now some 7 years later they have completed over seventy acquisitions. Nolop says that they have achieved their strategic goal, and have managed to shift their business to one that can provide a level of growth that they wish to deliver to their shareholders.

What is interesting is how, in the article, Nolop outlines process steps and shows that they are punctuated by specific decision points, in a classic BDM/BPM cycle. The decision points are discreet, and are implemented by a set of rules that have evolved over time from specific lessons learned, while the process has remained fairly consistent. Depending on the nature of the acquisition (“bolt-on” or “Platform”) different criteria (Business Rules) are applied, while the process remains roughly the same.

Nolop describes the process steps that a business sponsor is required to take as soon as an acquisition candidate is identified. These are specific formal steps leading to a series of qualification gates as the acquisition is considered, and several different groups of decision makers are successively involved until a rejection or a final approval is achieved. What becomes clear as we progress through the article is that it is not the process steps, but the rigor of the Business Decisions, and their supporting Business Rules, made at specific qualification gates, that is the key to the success of the program.

Building intelligence into those qualification decisions, and managing them effectively based upon the lessons learned over time, are the true differentiator for Pitney Bowes: in fact it is the logic behind the decisions, rather than the detail of the process, on which Orlop spends his ink.

Whether we are dealing with process at the strategic or the operational level, it is ultimately the Business Decisions and their supporting business rules that determine the character of the process. Success or failure of the process, over time, is ultimately going to rest on the effective management of the critical Business Decisions in the process. That is the role of BDM.